Welcome to your first step to buying a home with this Mortgage How to Guide

This site is packed full of information, tips, ideas and things you can use on your journey to buy your new home. Whether this is your first time buying a home or you are a skilled investor, there will be something in here for you. Please don't hesitate to text or call Dawn Robbins at 503-805-7878. My Website is on the link below

Ready to Buy a home? Here's your video guide tips and ideas

Credit- How to really move your score?

There's so much information and misinformation out there on how to impact your credit. We discuss the types of credit scores and a few tips on what you can do to move your score in the right direction!

What's Your Buying Power

Where do you get the biggest bang for your buck. Pay down debt, put more down or buy down the rate? If you have the additional funds available, and you will be keeping this home for awhile, it may make sense to buy down the rate. We do what's called a break even analysis to see what makes sense in your scenario.

Calculating your monthly payments

You can increase your buying power by potentially restructuring your debts. Every $50 in monthly payments is $10,000 in buying power. Sometimes it makes sense to consolidate items to help increase how much you can qualify for. But don't make any moves before you know for sure. Paying off old debts or closing cards may hurt more than help. Let us be your guide.

Are you a first time homebuyer?

The term is thrown around and has changed over the years. We discuss what it means to be a first time home buyer. .

Pre-qualification vs preapproval

So many lenders use these words interchangeably. You may have heard, "apply on line and get pre-qualified so you can shop," Essentially a preapproval means that you have have your file reviewed, credit pulled and discussed and or provided documentation to make sure your loan is good. This makes your offer stronger in this competitive market.

Financing options

So many choices out there and we cover just a very high overview a a few of the loan options.

What are closing costs

Closings costs are cover all the parties that transfer the property from the seller over to your name. We break down what they are and what they do.

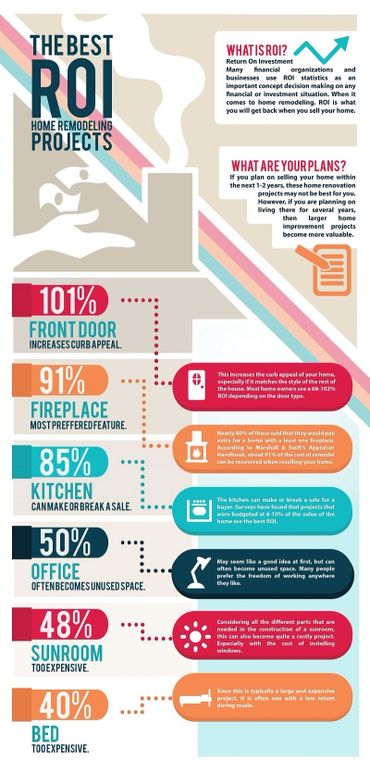

Your perfect home today and tomorrow

The perfect home is discretionary for sure. But I always believe the right one is out there. In your searches, take notes, photos, so you can keep track of what you like and don't like. Your agent will help you look at the property not only in todays market but what will it be in 2, 5 maybe 10 years when it is time to sell.

Where can I find a great property?

There are so many sources, zillow, redfin, trulia, real estate sites, to say just a few. We share some ideas on how to find the homes and simplify your search efforts!

Shortsale and Foreclosures, pennies on the dollar? Really?

Oh the late night ads. We talk about what really is a shortsale, foreclosure and how does that impact your negotiations in buying a home.

The ugly duckling is a swan!

Oh these are my favorites. Now if you are looking for a home where everything is already done and or brand new, then you will pay a premium of those updates or qualities. But the 1970's home that is solidly build, give me orange counters and shag carpet! Most buyers can't see past it, but to me, these are cosmetic items that will help you build equity fast.

Your real estate contract

Your agent will go through this in detail, we just have a very broad overview. But just remember, if its not in writing it didn't happen.

Video

Inspections vs Appraisals

The inspector is coordinated by your real estate agent and they will recommend a few that they have worked with that are good and reputable. They check the house top to bottom to make sure that everything works. The appraisal is coordinated through the lender and they make sure to run the comparisons against other home sales to make sure it's worth what you are paying for it.

What’s a contingency?

Contingencies explained. For the most part contracts are weighted heavily towards the buyer for protections. When you go under contract to purchase a home you will pay a small portion of earnest money. Its like lay away for you home and we'll say a commitment fee of sorts. Now that money goes towards your down and closing and it is protected, subject to "contingencies" that if they are not to your liking, you can exit the purchase and get your earnest money back to find another home.

Ready to upgrade? Buy before you sell!

With the current sellers market, many clients are afraid to sell or even list their current home before they have the new one secured. And what if something happens? We discuss ways to help you transition from your old house to your new home smoothly.

One month free?!!

Advertising can be misleading when they say one month free or no mortgage payment for the first month. We explain how that is calculated and how you can use this potentially to your benefit!

Do's and Don'ts when buying a Home

This is a nice little cheat sheet to highlight things to keep in mind when applying for your home loan. Click the link below to open the PDF

Protecting your credit

Here is a nice cheat sheet from American Reporting that shows the quick phone steps to freeze and unfreeze your credit quickly.

Hi, I'm Dawn Robbins! Who I am and What I do

About Me

If you’ve ever written a “Bio”, well that ranks right up there with going to the DMV, getting a physical, let’s just say not

on my top list of oooh I can’t wait. So I’m skipping the fancy lender stuff and just getting to the why I do things the way I do them. So here it goes…

ONE STOP SHOPPING- The benefit of being in the business for so long is I know good people at almost all of our local banks and lenders. I pride myself in not only knowing my lending programs, but knowing what other options are out in the market. It is just the right thing to do to get you to the right place if there is another program that is a better fit. Also just as important, if I do refer out, I still stay involved to see it through and only refer to people/lenders that I know and trust.

CREDIT - When someone takes the leap to see if they can qualify, it is intimidating, scary, and overwhelming. I’ve even

personally been there in my younger years and despite there is way more information out there to help nowadays, there's an equal amount of misinformation. That’s why I am so passionate about guiding clients on how to build their

credit through strategy and education. We have tools that will show you exactly what to do first to have the biggest impact.

NO DECLINES – I keep that feather in the hat and hold on to it for dear life. It’s a matter of pride. For myself just a

personal reputation, but also time, money and relationships. The worst thing that could ever happen is to get to the end and hear, oh oops. That’s just not going to happen. I will work with you to establish a plan and for some clients that may mean they are immediately able to move forward and for some that may mean a six month or one year plan, sometimes more. There's always a way. I do a lot of “outside of the box” type scenarios to find ways to make it work, but if I say it can be done, rest assured, you have a good solid approval.

THE HOMEOWNERSHIP DREAM– No one wants a loan officer to blabber on about loans like the Charlie Brown teacher. Listen, this is a vehicle to get you into your new home and for most, a necessary evil. Buying a home is an exciting time and a little intimidating for most! My goal is making sure there is a solid plan in place to achieve that dream within your comfort zone. So when it comes to the numbers part of it, well it should be fun and easy too!

KNOWLEDGE AND EXPERIENCE – My team used to call me the walking underwriting guide. LOL! Knowledge is power. How to structure and what to do in X situation, those are all things that you learn from being in the trenches. I am forever grateful for having the opportunity to work through the years in a high volume environment where I looked at 20-30 scenarios a day. There’s not much out there that I haven’t seen or dealt with before.

PERSONAL TIDBITS - Crazy Cat lady extraordinaire. My fur babies are Chester and Chloe and are both spoiled rotten. You might even hear them in the background in the evenings or weekends. I've been with my wonderful hubby Marty for over 30 years to which I could not do this without his love and support, albeit with the occasional eye role when he hears the words, "ooooh I have an idea". We zoom around on ATV's to get our adrenaline fix in every so often and laugh at the craziness our world has become. Our time is short is the big scheme of things, so might as well enjoy the ride.

Loan Products & Programs

I like to say one stop shopping which is a nod to one of our local stores here in the Northwest. There is so many options out there it is difficult to know which one is right. If it's out there in the marketplace, I make it my own personal goal to know about it and help you determine which will be the right real estate home loan for you.

- Standard 30 year fixed loans (Conventional)

- Jumbo Loans (Non Conforming)

- Home Equity Line of Credit Loans

- FHA, VA , and USDA loans

- A huge variety of Brokered Unique Options

- Private Money recommendations

- Personal Loan recommendations

- I personally work with a team of loan officers in several local institutions as well.

- I have a referral network of contractors and service providers that I know will treat you fairly and honestly.

Home Purchases & Refinances, Anything House and Home

Being in lending for over 20 years doesn't happen by accident. It's loving what you do and helping people accomplish their hopes and dreams for that NEW home, updating an existing home or ways to restructure finances to make things more comfortable for years to come.

REVIEWS

Hear what some of my past clients have had to say directly through Experience.com. Click below.

Photo Gallery

Contact Us

BRANCH NMLS. 2321717

1837 PACIFIC AVE #114

FOREST GROVE, OR 97116

844-255-9738 or directly at 503-805-7878

Dawn Robbins, Sales Manager NMLS 432345

Disclosures

NMLS Consumer access https://www.nmlsconsumeraccess.org

Copyright © 2023 To Guide You Home - All Rights Reserved.

Powered by GoDaddy

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.